Wiedza

4 lipca 2024

Polish pioneers of entrepreneurship 35-year-old businesses in Poland.

Intro

This report, published by Fundacja Firmy Rodzinne (FFR, Family Business Foundation) in cooperation with EY is based on data collected and processed by Dun & Bradstreet, an analytical business intelligence agency. Analysed dataset describes 13,776 businesses that were established in 1989 – the year that marked the beginning of economic transition in Poland.

According to Eurostat, 5-year enterprise survival rate in EU-27 is 45% (in Poland just below 40%), 53% of the businesses founded 35 years ago still in operation is a huge success for their founders and managers, especially taking into account what happened to global economy in the last five years.

The last five years have been characterized by high volatility and factors that can be classified as extraordinary over 35 years. It was a real test for many companies, management and flexibility. Events such as the COVID-19 pandemic or the war in Ukraine have caused significant economic and ideological changes, which have also affected the functioning of many enterprises, including the oldest ones in Poland.

Discoveries

This report is a continuation of the report prepared by FFR five years ago. Our goal is once again to analyze and present the current situation of enterprises, which are a factor that binds the economy together and affect its condition and shape.

Resilience

One of our main observations is that over the last five years, 1595 companies founded in 1989 have closed down. The remainder is still active. It should be noted that despite the above-mentioned macroeconomic events, which have given many entrepreneurs sleepless nights, during this period.

Surprisingly, far fewer businesses closed this year than, in the years 2008-2011, during the global financial crisis. Back then, more than 2800 Polish companies established in the first year of the free economy’s operation were shut down.

Racing with the inflation

Based on the financial data available for the group of the largest 147 companies from the described database, we estimated that in 2019–2022, the activity of 35-year-old companies grew by more than 39%, which is ahead of the inflation calculated for the same period by almost 10%.

It’s worth underlining that F147 consists of the biggest companies, for which the financial data was available. This also means that we should pay special attention to this calculation performed in division between different sizes of 35-year-old businesses.

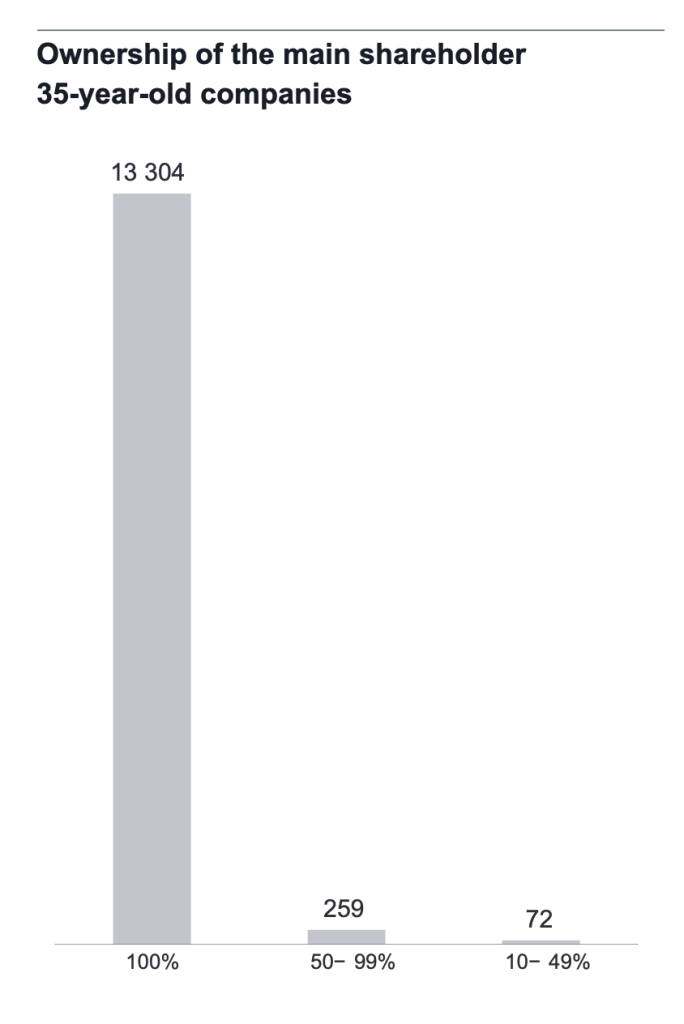

Ownership structure – succession challenges for the sole proprietorships

About 97% of the analysed businesses are being run in the form of sole proprietorship which implies serious challenges for succession, especially that only three companies in the database have appointed succession proxies.

Gender equality – are women leading the 35-year-old businesses?

Only 2017 businesses, which account for 15% of the researched enterprises, have a woman as a leader. Many of these were also founded by women, as 1800 out of those 2017 are sole proprietorships.

Macroeconomic background in the last five years

Covid pandemic

The lockdowns and restrictions introduced had a direct impact on the reduction of production and consumption, which translated into a decline in GDP in 2020. The domestic and global economy was supported by anti-crisis fiscal packages and the accommodative monetary policy of central banks. The government’s economic support package, including subsidies for companies and protection programs for employees, helped to mitigate the immediate shock, but the effects of the pandemic are still being felt today.

It is worth noting that factors such as interruptions in supply chains or the change in business models to more digital ones have forced rapid adaptation, but also created opportunities for innovation and the search for new solutions.

Russia invading Ukraine

In February 2022, we witnessed another major geopolitical upheaval when Russia invaded Ukraine. Economic uncertainty contributed to rising commodity and energy prices, and led to the disruption of supply chains, which has put pressure on inflation.

In addition, Poland has become a hospitable home for millions of refugees from Ukraine, which on the one hand posed a logistical and social challenge, and on the other hand could have contributed to a certain consumption impulse and an increase in labour supply, although this impact is difficult to estimate unequivocally.

Inflation

After a relatively stable period of low inflation in the years leading up to the pandemic, prices began to rise sharply, and in 2022 inflation reached levels not seen since the 1990s. Price increases were driven, m.in by rising energy and food commodity costs, supply chain disruptions, rapid wage growth, and fiscal stimulus.

The central bank responded by tightening monetary policy, which was associated with an increase in interest rates. The high level of inflation that Poland experienced in 2021-2024 made it difficult to plan financing and manage costs and prices. For family businesses, this meant the need to react quickly to changing market conditions, including the rising costs of raw materials and goods.

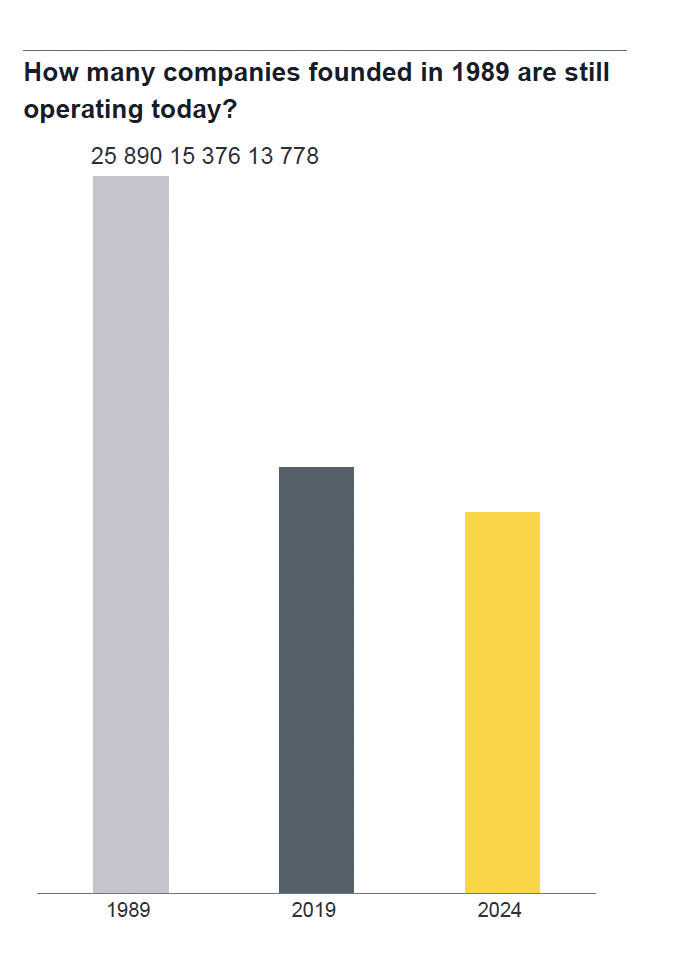

How many companies founded in 1989 are still operating today?

There are 13,778 businesses founded in 1989 still operating today. It equals to 53% survived until today. This is a 6 percentage points decline compared to 5 years ago.

If we look at the absolute numbers, we are dealing with 1598 companies with over 30 years of tradition, which had to stop their operations for various reasons.

At this point, there is a fundamental reflection on strategies that would allow companies to effectively adapt (and not liquidate), including restructuring, transformations, ownership changes, while maintaining the knowledge, know-how, human capital and, above all, social capital developed over the years.

It is also worth noting that, according to previous analyses, the financial crisis of 2008–2011 caused a greater regression among the longest-operating Polish companies than the recent crises resulting from the COVID-19 pandemic and Russia’s aggression against Ukraine.

– Polish and European statistics show that entrepreneurs are a rare and useful species that should be effectively protected – points out Eleni Tzoka-Stecka, Project Coordinator at FFR. – Although there are still daredevils setting up companies, with each subsequent year since its establishment, an increasing number of them are disappearing from the economic horizon. The European Commission is aware of this, and with its activities and financial assistance it supports both start-ups and companies already established on the market – she adds.

The European Commission has funded a number of initiatives to increase the resilience of businesses, and their beneficiaries are also Polish entrepreneurs. Particularly noteworthy are the Resc-EWE tools, which in 2023 were awarded the European Commission’s Oscar for the best project in the category „Development of entrepreneurs’ competences”.

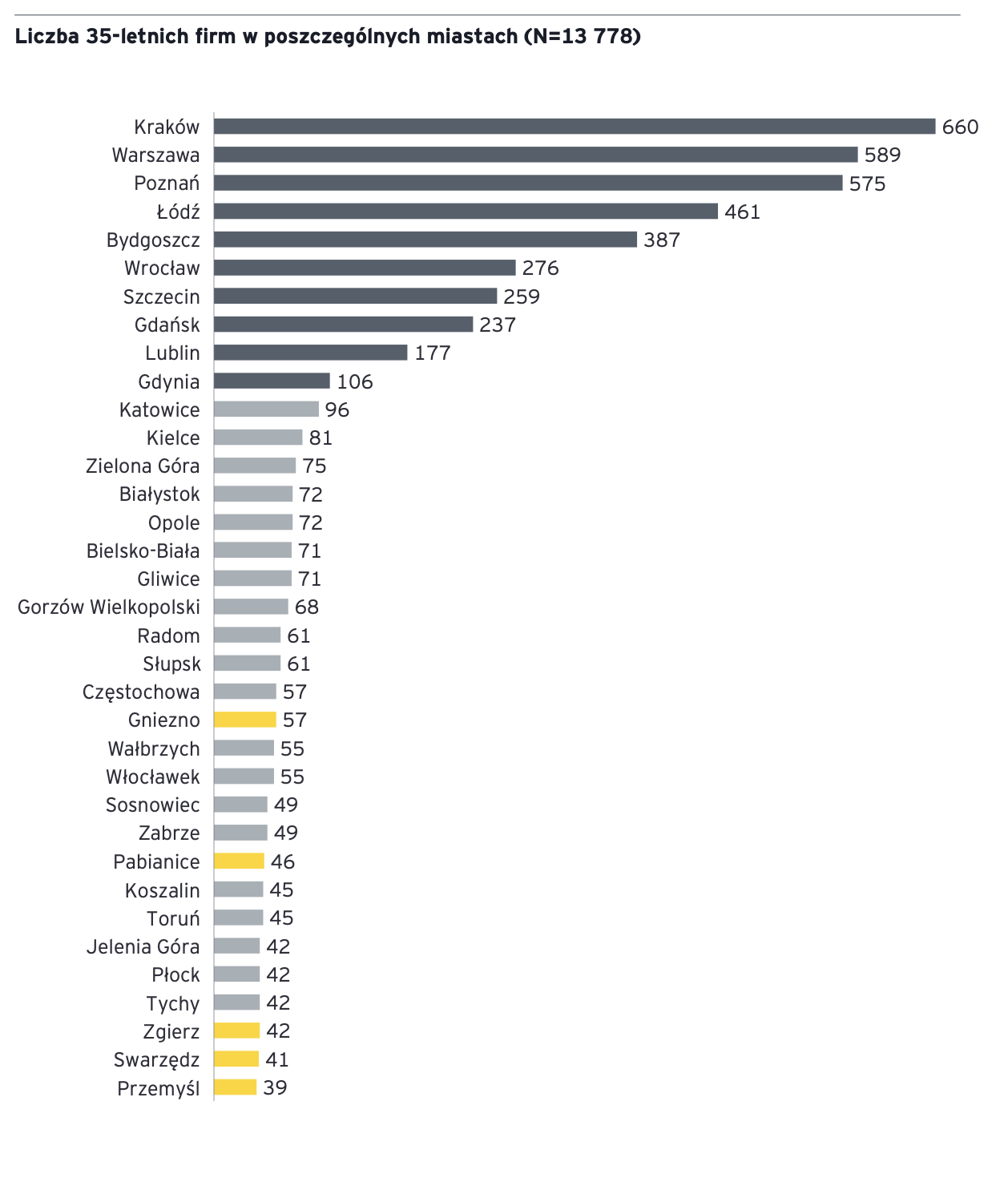

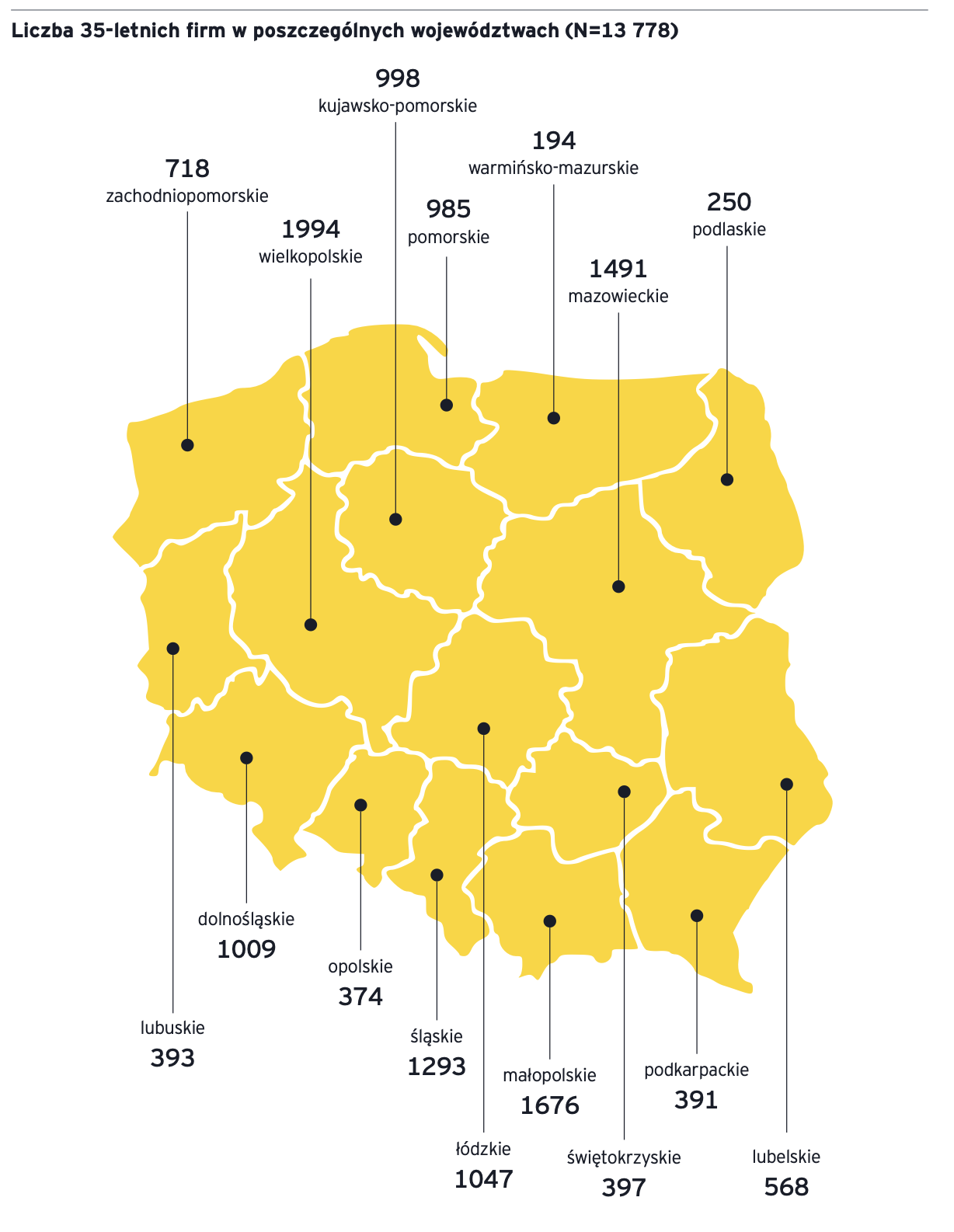

Where are the 35-year-old businesses located in Poland?

Just like five years ago, the largest number of companies from the group of Pioneers of Entrepreneurship is located in the Wielkopolskie Voivodeship. On the other hand, in the category of cities, Krakow holds its leading position.

As this is 35th anniversary of free economy in Poland, we present Top 35 locations where we find the most 35-year-old enterprises. Particularly noteworthy is the presence of smaller urban centres in the ranking, with a population of less than 100,000 inhabitants, marked yellow on the graph.

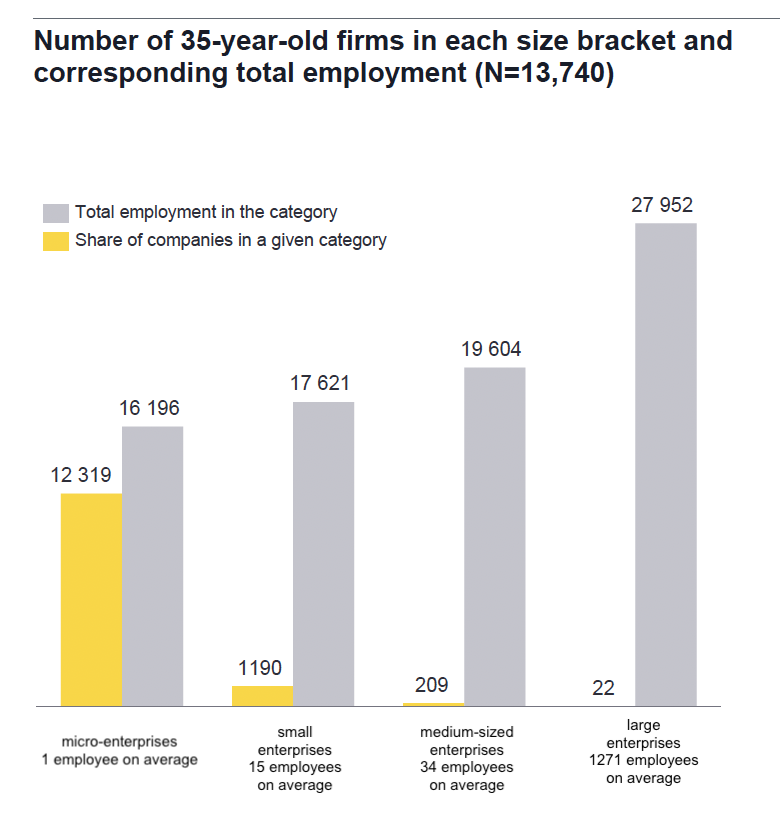

What is the size of Polish 35-year-old businesses?

The database we received included information on the number of employees for 99.7% of companies, which is the basis for their classification as micro-, small, medium and large enterprises. It should be noted, however, that making a partial correction of this information, taking into account the available data on revenues, allows us to assume that the number of companies in the small and medium-sized category is higher than it could result from the number of employees alone.

Anyway, we settled for using the number of employees to determine how many of the analysed enterprises are in each size and – what is much more interesting – what is the structure of employment divided between these size-based categories.

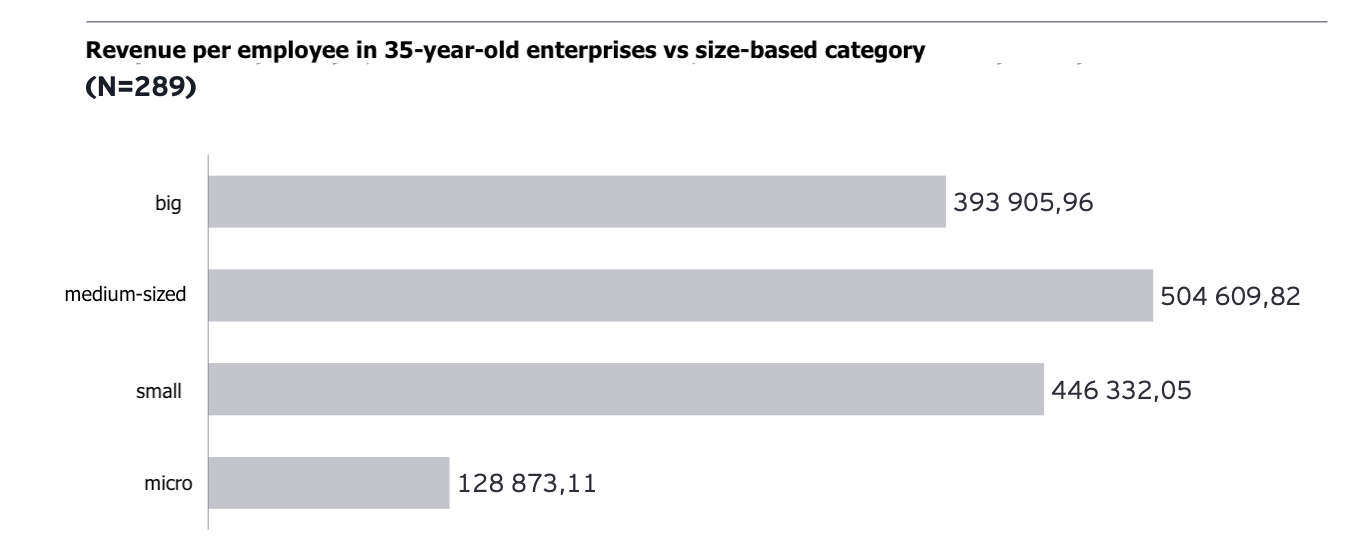

Medium-sized enterprises – productivity champions

We calculated the average revenue per employee using the revenue data for 2021, which is the most representative: it gives the calculations a higher analytical value than the most recent 2022 data provided by Dun & Bradstreet. It should also be emphasized that in 2022 the armed conflict against Ukraine began by Russia, which makes this year unusual and less representative, just like 2020 — when the COVID-19 pandemic started.

Our calculations show that medium-sized enterprises stand out from other categories in terms of efficiency – they generate much higher revenues per employee.

Only 9% of Polish 35-year-old businesses are companies

As many as 85% of the enterprises described in the report are sole proprietorships. These are 11,747 entities, out of which 1058 (9%) are small and medium sized, and five of them are big enterprises, which employ together 1977 people.

Adding to that – none of those big enterprises operating in the form of sole proprietorship have assigned the succession proxy.

What situation would the organisations have to face given circumsdtances such as serious disease or death of the business owner?

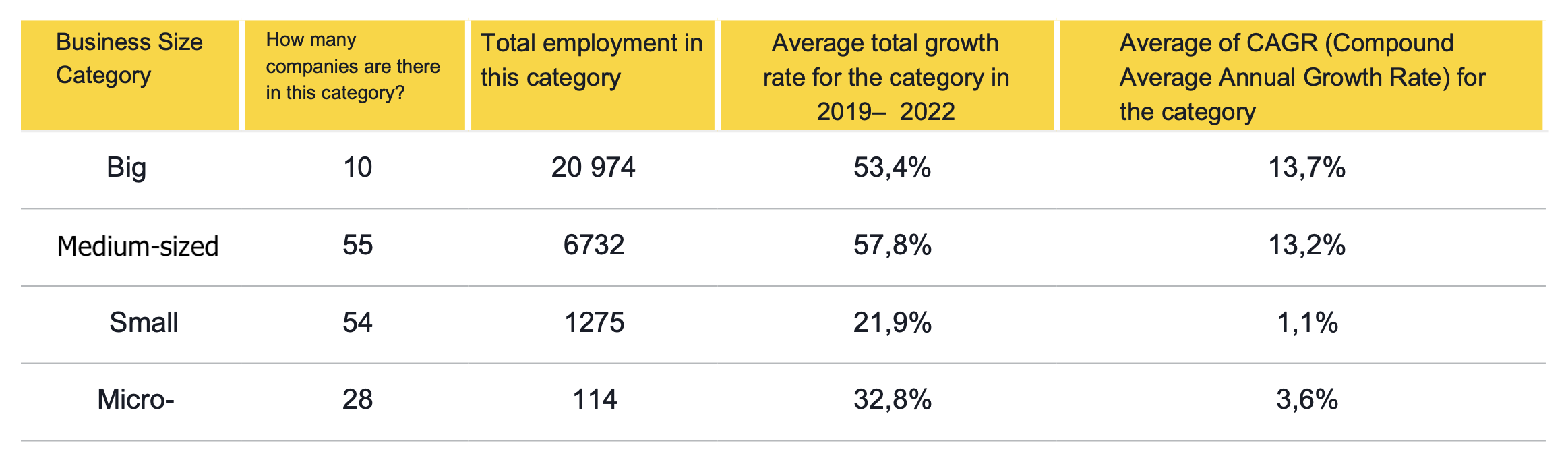

Two speed development

Based on data for the years 2019–2022, we examined the dynamics of revenues in companies celebrating their 35th anniversary.

The analyzed group included 147 enterprises for which the data was complete. We will refer to them as the F147 group.

The average increase in revenue for the entire F147 group was 39.55%. This is a result that gives reasons for optimism, especially in the context of the fact that the cumulative inflation in the period December 2019 – December 2022 amounted to 29.82% (according to based on monthly intervals data from GUS – Central Statistical Office,).

Comparing the total inflation rate with the performance of individual categories of companies provides more insightful conclusions. Although large and medium-sized enterprises coped with inflation relatively well, micro-enterprises were only 3 percentage points ahead of it, and small companies lost the race against inflation.

What do 35-year-old businesses do?

The table presented below shows that companies from the most numerous sections of the PKD account for more than half of all enterprises that have been operating on the market for 35 years and which have been included within the analysis.

Kategorie

10 ostatnich wpisów:

- PREMIERA RAPORTU O SENSIE i SZCZĘŚCIU W FIRMACH RODZINNYCH

- Raport “O sensie i szczęściu w firmach rodzinnych”

- Raport “O sensie i szczęściu w firmach rodzinnych”

- Warto mówić o dobrostanie przedsiębiorców

- Sukcesja. Największe wyzwanie dla rodzinnych firm

- Spotkanie mentoringowe dla przedsiębiorców i mentorów w firmie rodzinnej Sądecki Bartnik

- Raport “O sensie i szczęściu w firmach rodzinnych”

- Globalny Indeks 500 Firm Rodzinnych

- Reminiscencje o Japonii

- Fundacja rodzinna bez profesjonalizacji to nadal NIEudana sukcesja

Tematyka wpisów: